Article by Madison Kang, Mark Keppel High School Senior

Financial literacy influencer and author Yanely Espinal visited San Gabriel High School on October 9 as a stop on her Mind Your Money book tour. Espinal incorporates pop culture and relatable conversations to make this topic engaging for youth who, like her, didn’t grow up learning about money. Her tour coincided with the passage of California’s new law, AB2927, requiring high schools to offer financial literacy classes by 2027-2028 and making it a graduation requirement by 2030-2031.

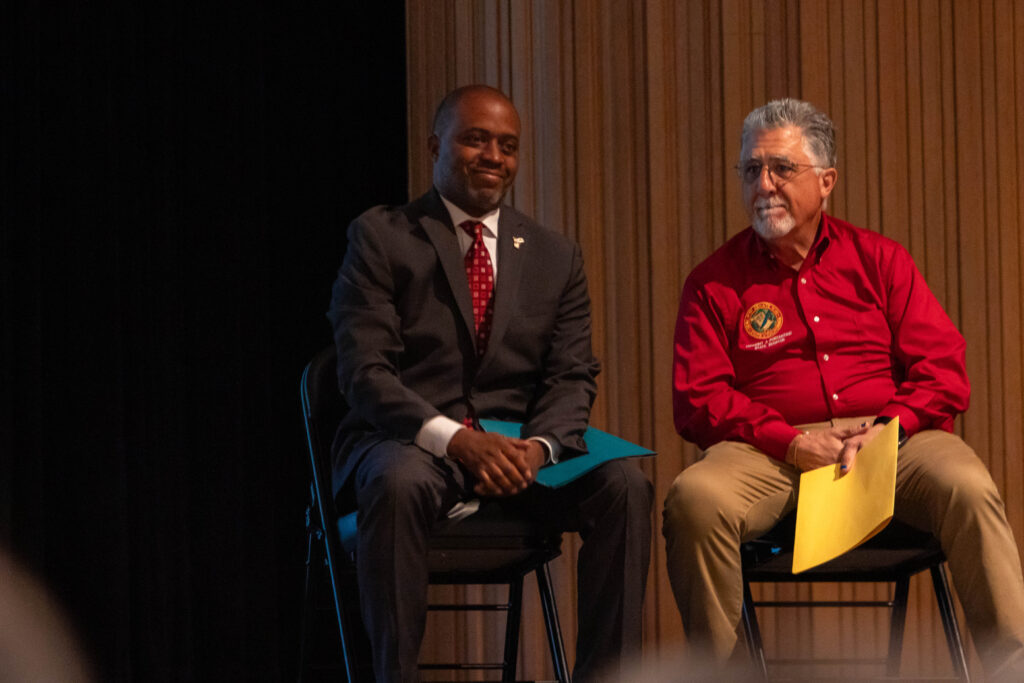

California Superintendent of Public Instruction Tony Thurmond and State Senator Anthony Portantino introduced Espinal, stressing the importance of teaching personal finance. Thurmond was raised in an immigrant family with little financial exposure and praised the new law and Espinal’s dedication to spreading financial literacy. Portantino highlighted the need for students to gain independence. Both officials thanked Timothy Ranzetta, founder of non-profit Next Gen Personal Finance, whose work plays a key role in educating today’s youth.

Espinal shared her upbringing in Brooklyn to immigrant parents, where “money was something to be ashamed of.” She talked about her parent’s lack of understanding of finances, leaving her without guidance. Because of this, she accumulated over $20,000 in debt and spent years thinking material items signaled wealth. With disciplined planning, however, she paid off her debt in just 18 months.

Espinal challenged the SGHS students to rethink wealth, asking, “How can you tell if someone is wealthy?” The audience’s materialistic responses, focused on clothing, cars, and homes, allowed her to underscore a key point: wealth is not about visible status, but financial security and money management.

This brought Espinal to emphasize the emotional aspect of money. “What does it mean to have money?” she asked, prompting students to think beyond surface-level perceptions of wealth. “Companies will try to get you to feel emotional,” she explained, referring to the phrase “TikTok made me buy it” as a prime example of how online culture drives impulsive spending.

Students then participated in an interactive activity: imagining one person found $20 and had to offer a partner some money. If the partner declined the amount offered, neither would keep anything. Most students decided to split the money evenly because it was the fairest option. She then asked if their opinions on money changed if the partner had just found $5 on the floor. This exercise demonstrated the importance of understanding the value of money, especially when managing personal finances.

As California becomes the 26th state to mandate personal finance education, Espinal expressed excitement, thanking Next Gen Personal Finance for their role in this change. “Everyone should know what to do with their money,” she said, emphasizing the need for financial literacy to avoid mistakes like hers.

Yanely Espinal distributed copies of Mind Your Money to several lucky SGHS participants, but emphasized the purpose of her visit went beyond promoting her book; she wants it to be part of movement aimed at empowering youth with financial literacy, equipping them to navigate the complexities of managing money in today’s digital world, and helping them make confident financial decisions to secure their financial future.

State Superintendent of Public Instruction Tony Thurmond and State Senator Anthony Portantino were on hand at the SGHS Mind Your Money tour stop. Both were strong advocates for the new legislation requiring a financial literacy class as a graduation requirement. (Photo: Grant Sapcharoenlert)