Our hearts and thoughts go out to the people and communities affected by these fires. We are focused on our customers and helping them recover from the largest fire event we have ever experienced in the state.

Keeping our promise to customers

Our claims force is the largest in the industry and we are bringing the full scale and force of our catastrophe response teams to help customers recover – whether they are on the ground in LA or across the country.

As of mid-February, we’ve received around 11,400 total home and auto claims and have already put more than $1.35 billion in advance payments back into customers’ hands.

Immediate support for customers affected by wildfires

Your safety and recovery are our top priorities. If you’ve been impacted by the wildfires, here’s how we can help:

Filing Claims: If you’ve experienced damage, you can file a claim through your local State Farm agent, calling 1-800-SF-CLAIM, or using the State Farm mobile app or visiting statefarm.com.

Premium Payment Assistance: Our agents are ready to provide premium payment extensions for those facing financial strain.

State Farm Catastrophe Team deployed

The State Farm Catastrophe Response Team has deployed to California to help residents recover from this catastrophe. Our catastrophe response includes a dedicated, mobile workforce, specially trained to handle catastrophe claims and prepared to go anywhere in the country. Our on-the-ground team is fully equipped to respond to our customers’ needs in the face of these devastating wildfires.

Our response also includes local California State Farm agents who live and work in these same neighborhoods as our customers, and they are joined by thousands of employees in centralized care centers across the country virtually helping answer customers’ questions and file their claims. Our remote claim teams can conduct virtual meetings and inspections with our customers.

Tips to help protect customers from fraud and scams

There unfortunately may be some dishonest contractors attempting to take advantage and defraud or scam residents as they seek to rebuild or repair their homes. The following tips will help protect from fraud or scams:

If you have property damage to your home, contact State Farm as soon as possible to report your claim.

Make temporary repairs as timely as possible to prevent further damage, but do not make repairs that go beyond temporary mitigation until the damages can be assessed by State Farm. Preserve any items or materials moved or taken from your home until you speak with your claim handler.

Be careful not to sign any documents with a contractor or builder before fully reading and understanding them.

Deal with reputable local contractors whenever possible. Take time to verify references and licenses and get multiple quotes.

Insist on a written estimate and work contract with a breakdown of costs, payment due dates, and contact information. Do not agree to pay for repairs in full before the work has been completed to your satisfaction.

Be on the lookout for red flags such as asking for full payment before starting the work, lack of communication with you, or frequent unexpected expenses.

When considering short- or long-term living accommodations or lodging while making repairs or rebuilding, verify the identity of the landlord (for example, meet the landlord in person), read reviews by other people, and don’t pay a deposit until you have seen the property in person.

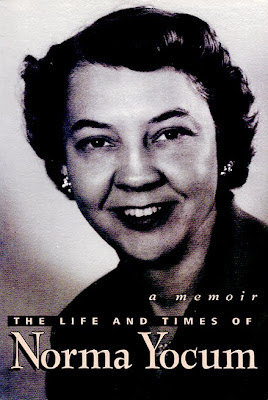

We encourage you to learn more and discuss your unique needs with State Farm Agent Regina Talbot at (626) 357-3401